Risks to the Global Economy Tilting to the Downside

While the current global economic expansion is estimated to reach 3.9% for 2018 and 2019, the medium-term risks which include the impact of higher interest rates, inflation, muted wage growth and greater geopolitical discord are shifting forward. Actions such as trade tariff threats, retaliatory measures and threatened reduced diplomatic ties undermine the stability of the global economic system. The latest global purchasing manufacturing data show a loss of momentum. The broadening trend away from constructive and cooperative global engagement is becoming disruptive to the point that it calls into question global economic stability.

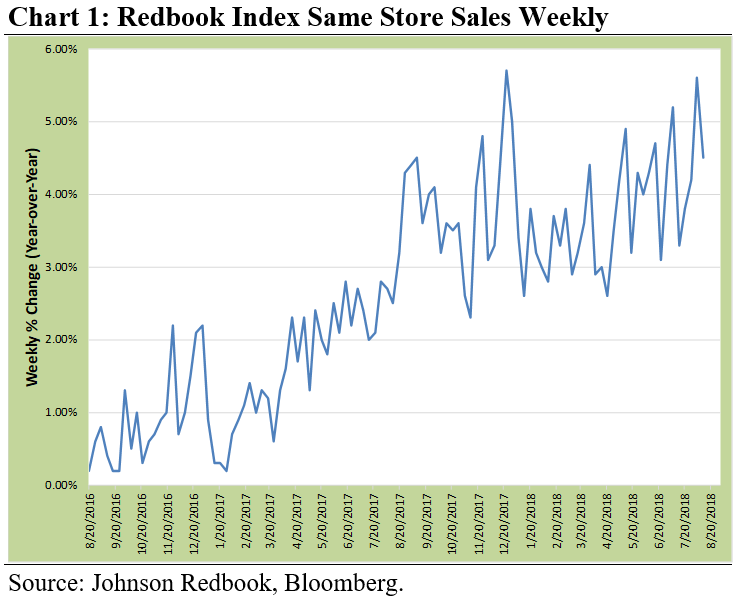

In spite of this growing discord globally, conditions in the United States appear somewhat insulated. The U.S. consumer, for example, is responding to favorable economic conditions including higher wages, increased employment and an increasing labor force participation rate. U.S. retail sales, as shown in Chart 1, have been trending upward since the beginning of 2017.

This being said, if we look a little closer at past cycles shown in Chart 2, which includes inflation and wage data, the uptick is no surprise. If we then look at data at the onset of a recession (grey bands), we can see how quickly the consumer can pull in the reins. Given that the United States economy is driven to a large extent by consumer spending, any negative disruption to employment and wage growth, and/or modest inflation numbers, could be a reason for concern.

Whether it is Turkey’s excessive dollar denominated debt or Saudi Arabia’s suspended diplomatic ties with Canada or the tariff threats around the world, the issue, in our opinion, is a basic global conundrum: debt-encumbered countries are more constrained in their ability to grow. Therefore, coordinated global economic policies to support stability and durability are crucial. In an increasingly challenging macroeconomic backdrop, we believe the United States will not remain insulated.