Q2 Commentary: Job Growth & Consumer Spending

I am always optimistic when the calendar moves into a new year. The warmer weather of spring is approaching and with it hope that the new year will be better than the just completed year. In the first quarter, the better start to the year I hoped for did not fully materialize because inflation accelerated, delaying any reduction in interest rates by the Fed. The delayed Fed rate cut pushed interest rates higher and bond prices down. Higher interest rates frequently drive equity valuations and push prices down because the discount factor, or the incorporation of the time value of money and risk inherent in equity investing, increases. But the capital markets often deliver the unexpected. For the first quarter, the unexpected was a surge in equities of more than 10%. The increase in stocks was positive in the first quarter alongside strong job growth, giving us a resilient consumer report. Like the changing of the years and seasons, the changing of quarters also brings a sense of optimism, and since the first quarter did not deliver all I was expecting, I could not wait to see what the second quarter would deliver.

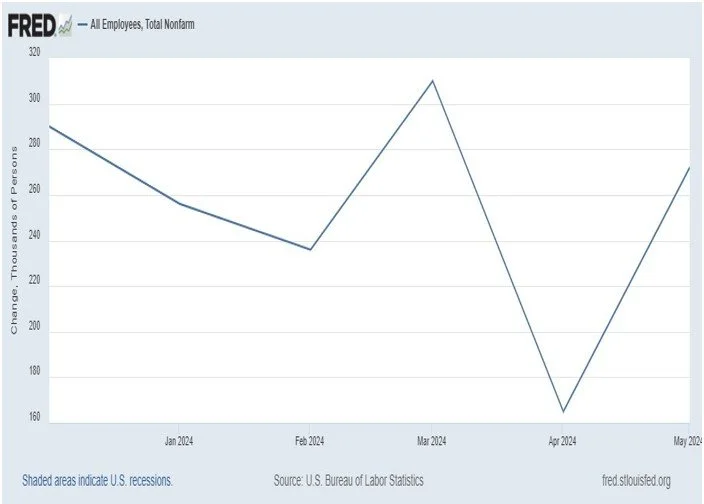

The chart above left shows the expected acceleration of inflation in the first quarter. However, there was an unexpected jump of nearly 0.4% higher inflation in February and March. When the jumps in inflation occurred, equities were expected to decline because, as noted above, the discount factor increases. But the reality is that higher inflation increases the risk for all investments and higher risk results in a decline in value, so the prices of most companies and bonds decline. We did see a decline in the value of bonds, while stocks increased. The stock market is forward looking and the increase in the first quarter happened due to the anticipated decline in inflation in the second quarter, and the rest of 2024. Moreover, those expectations included additional gains in jobs and consumer spending, and therefore a growing economy. The stock market's expectations did materialize in the second quarter as inflation declined, job growth averaged more than 200,000 per month (above right), and GDP is expected to have increased a little less than 2.5%, all solid numbers. In response to the economic developments, the bond market posted a small gain, and stocks across the market cap spectrum increased about 3.7%. The downside of the second quarter was concentrated on the consumer spending growth, or lack thereof. While remaining positive, growth did decline into June. I expect consumer spending will be positive in the third quarter, but the growth rate will be below recent years because consumers have used up most of the pandemic related money, credit card balances are high, and job growth is likely to slow – but remain positive.

The second quarter's equity performance was driven by two factors. First was earnings growth and expectations of accelerated earnings growth, and second was artificial intelligence. First quarter earnings growth came in at about 5% while second quarter growth is expected to be a little less than 9%. Thus, the first quarter stock market performance was foreshadowing an improved environment. Artificial intelligence related companies outpaced the overall stock market with semiconductor company Nvidia leading the surge by rising 50%, to its highest in June.

Other AI (Artificial Intelligence) companies such as Microsoft, Alphabet, and Amazon also performed well in the second quarter, and we expect the AI-led boom will broaden over time to include more industries and companies, offering time to add value from AI companies to client portfolios.

Outlook

We have indicated above that we expect the job growth should slow from the robust growth of the past two years, and this slower growth will weigh on consumer spending. Consumers are about 70% of the economy and the lower growth in consumer spending means the growth rate of the economy will fall but is likely to remain positive for the rest of 2024. Equity markets are likely to follow earnings and current expectations are looking for positive earnings growth in the third and fourth quarters. The bond market is also likely to post positive returns because inflation is likely to decline closer to the Fed’s target of 2% the rest of the year, and coupled with slower job growth, gives the Fed room to cut rates at least once this year. On balance, the economy is currently growing at a solid pace, but we are staying ever vigilant for unexpected problems that could derail that growth.

Clinton S. McGarvin, CFA, is a Senior Portfolio Manager. Clint is a part of the investment team covering Global Equities, Fixed Income and Real Estate Investment Trusts. He is involved in all aspects of managing client portfolios and has worked in the investment industry for more than 16 years with a strong record of accomplishment of equity research, portfolio management, and client service. To speak with Clint McGarvin, please contact our office at (503) 292-1041 or via email at info@allentrust.com.