The Fed’s Decision

As anticipated, the Fed raised the target rate by 0.75%, bringing the rate up to the range of 2.25% - 2.50%. The statement and the press conference gave both pessimists and optimists comments in line with their outlook. The Fed noted that inflation is much too high and suggested that they would rather err on the side of raising rates too much rather than too little. Chairman Powell also commented that the Fed may slow the pace of rate increases because this increase and the June increase have not worked their way through the economy and the Fed needs to remain data dependent.

Treasury rates reacted quickly with rates across the yield curve declining but short-term (1-3 years) rates falling more than longer (5+ years) rates. This reaction is largely based on Chairman Powell’s comments that the pace of rate increases may slow.

The past rate increases, again not fully incorporated, have slowed the economy but the extent is not yet known. The first estimate for second quarter GDP declined 0.9% following the 1.6% decline in the first quarter. This number will most certainly be revised, and we think it will be revised higher as some economic data out this week points to better economic activity. Exports in June (not fully incorporated in the first estimate) were better than expected and durable goods orders also surpassed expectations.

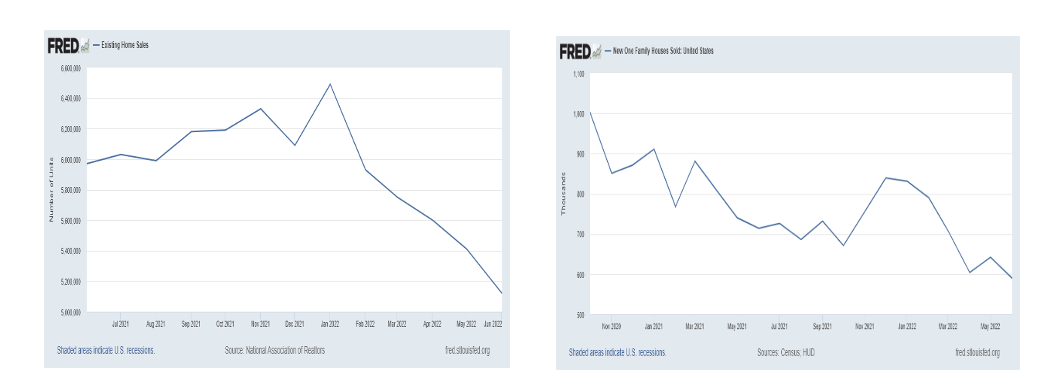

On the other hand, the housing market continues to weaken with existing, new and pending home sales plunging in June.

Consumer spending has also weakened, particularly on goods, with consumer spending on services such as healthcare and restaurants supplying the upside in personal consumption expenditures. Business and government spending offered no upside during the second quarter. Exports and consumer spending on services were the only bright spots in second quarter GDP, and these offer optimism for the future.

The growth in exports indicates some regions of the world are expanding and demanding U.S. goods. The weaker growth and the higher interest rates are putting downward pressure on demand and inflation in the U.S. and the growth outside the U.S. will at least partially support our internal growth. This will be especially true since we expect inflation to decline and interest rates to not rise as much as the market. If this proves to the case, equity markets will come back sooner than many expect, and we are looking for opportunities to add quality and growth to client portfolios.

Conclusion

The Fed’s decision to increase rates by 0.75% was expected, but we and the markets did not expect Chairman Powell to announce the Fed could slow the pace of rate increases. This comment fueled the rise in both stocks and bonds. Stocks are up and yields are down on expectations that inflation will be dropping. We believe that inflation is coming down and will bring interest rates down along with it. This opens investing opportunities in both stocks and bonds, primarily in those investments that have been hit hardest by the rise in inflation.

If you have any questions or comments, please contact our experts at Allen Trust Company by phone: 503-292-1041 or by email: info@allentrust.com.