Short-Term Recaps, Long-Term Realities, and Yogi Berra’s Wisdom

Yogi Berra was spot on when he said, “It's tough to make predictions, especially about the future.” This quote from Yogi applies each year to capital market participants who love to predict what the economy will do and how much stocks are going to change that year. When assessing the predictions at year end, we find all, or almost all predictions, are proven inaccurate. Thus, we prefer to follow what is unsaid in the quote from Yogi. We choose to avoid predictions and instead study what happened in the short-term and build expectations of the long-term.

Why Not Predictions?

To highlight our focus on the long-term, consensus expectations for market winners during the first Trump administration was focused on bank, energy, and consumer stocks. Conversely, those stocks were expected to be big losers during the Biden administration. However, as shown in the chart, the results were vastly different. Energy, bank, and consumer stocks outperformed during the Biden administration relative to the first Trump administration. Thus, a focus on the short-term, typically, does not benefit clients.

A Recap of the Short-Term

The economy expanded at a robust pace in the third quarter of 2024, increasing expectations of continued gains in the fourth quarter of 2024 and into 2025. The election results delivered “A Tale of Two Markets” as equities showed a stark contrast in performance before the election compared to after. Unfortunately, the bond markets did not react as favorably in the fourth quarter to the Fed’s adopted outlook of fewer rate cuts over the next year.

Furthermore…

The U.S. economy expanded at a solid 3.1% led by a 3.7% advance in consumer spending and a 1% growth in business spending.

Consumer spending in October and November trailed off a little compared to third quarter spending, but it remains above 3% annualized and is resulting in expectations for GDP growth of about 2.5% in the fourth quarter.

Equity markets started the quarter falling about 0.5% prior to the election, but afterward, U.S. large cap stocks were up about 3% to finish the quarter up about 2.4%.

The bond markets reacted more to comments from Fed governors than to the outlook for faster economic growth as rates surged higher, resulting in bonds declining 3.06%.

The fourth quarter was a good quarter, and the near-term outlook should also be considered similarly; however, the 2025 outlook becomes much cloudier.

Tax Cuts and Tariffs and Forecasts – Oh My!

Tax cuts and fewer regulations have contributed to accelerated economic growth; however, the reason for a cloudier outlook is the threat of tariffs and the reactions by trading partners. Here are two possibilities to consider:

If any tariffs are implemented and they are limited in scope to one country, then the result to the economy will be limited as well and the economic engine of the U.S. will continue the recent expansion. Our base case is the tariffs will target one country and are therefore not inflationary.

If, however, the tariffs target more countries, likely resulting in a trade war in which all participants are hurt, along with an acceleration of inflation.

Focusing on the Long-Term

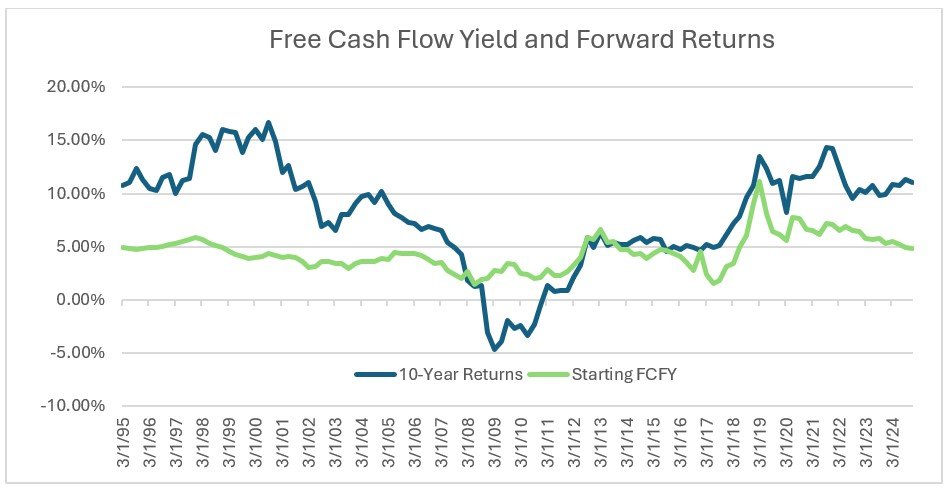

The chart below shows what we think is one of the better predictors of future stock market performance, the free cash flow yield – the aggregate cash after all expenses are paid, divided by the price.

The chart shows that the free cash flow yield is a good but not perfect predictor of future market performance. For example, the free cash flow yield on the far right of the chart is the yield on December 31, 2014, and was about 5%. Also on the far right is the subsequent 10-year return ending December 31, 2024, was just above 10%, consistent with history.

The current free cash flow yield of 2.8% suggests that returns are likely to be well below the historical average over the next 10 years. The markets will do what they do in the short term; we prefer to focus on the long-term outlook – the long-term cash generating power of companies since this is what drives long-term performance far more than who is in the White House. With that said, we are optimistic that tax and regulatory cuts will prove beneficial to investors.

We are here to help you navigate the uncertainties of the market—if you have any questions or need guidance, don’t hesitate to reach out.

Clinton S. McGarvin, CFA, is a Senior Portfolio Manager. Clint is a part of the investment team covering Global Equities, Fixed Income and Real Estate Investment Trusts. He is involved in all aspects of managing client portfolios and has worked in the investment industry for more than 19 years with a strong record of accomplishment of equity research, portfolio management, and client service. To speak with Clint McGarvin, please contact our office at (503) 292-1041 or via email at info@allentrust.com.